Focus: Scalping, Swing Trading, and Trend Following (Explained Simply for Beginners)

If you’re learning Forex trading, one of the first questions you’ll ask is:

“Which Forex strategy actually works?”

The truth is simple:

There is no magic strategy.

Only strategies that fit your personality, time, and discipline.

Today, we’ll break down three popular and proven Forex trading strategies:

- Scalping

- Swing Trading

- Trend Following

And most importantly, which one is practical for Beginners.

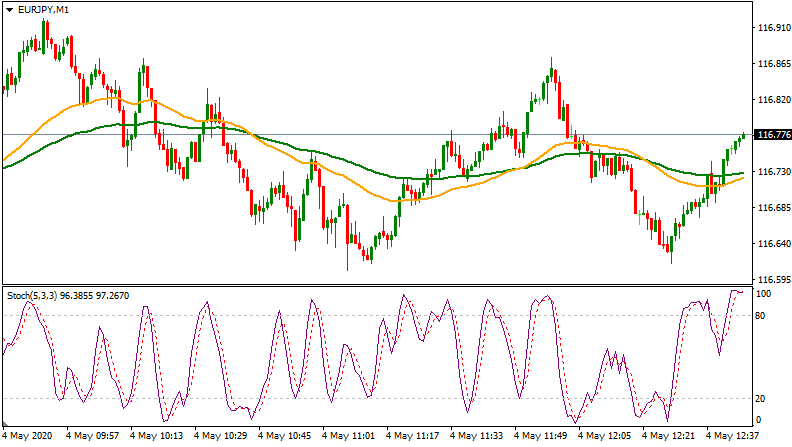

1️⃣ Scalping Strategy (Short-Term & Fast-Paced)

4

What Is Scalping?

Scalping involves opening and closing trades within minutes to capture small price movements (5–15 pips).

Traders use:

- 1-minute chart

- 5-minute chart

The goal is small profits repeated many times daily.

Real-Life Example

Let’s say EUR/USD moves from 1.1000 to 1.1007.

A scalper enters quickly and exits after gaining 7 pips.

They may do this 5–10 times in a session.

Pros

- Fast results

- Many opportunities daily

Cons

- High stress

- Requires full concentration

- Spread costs reduce profit

- Overtrading risk

For most Beginners with a 9–5 job, scalping can be difficult unless you trade during specific sessions.

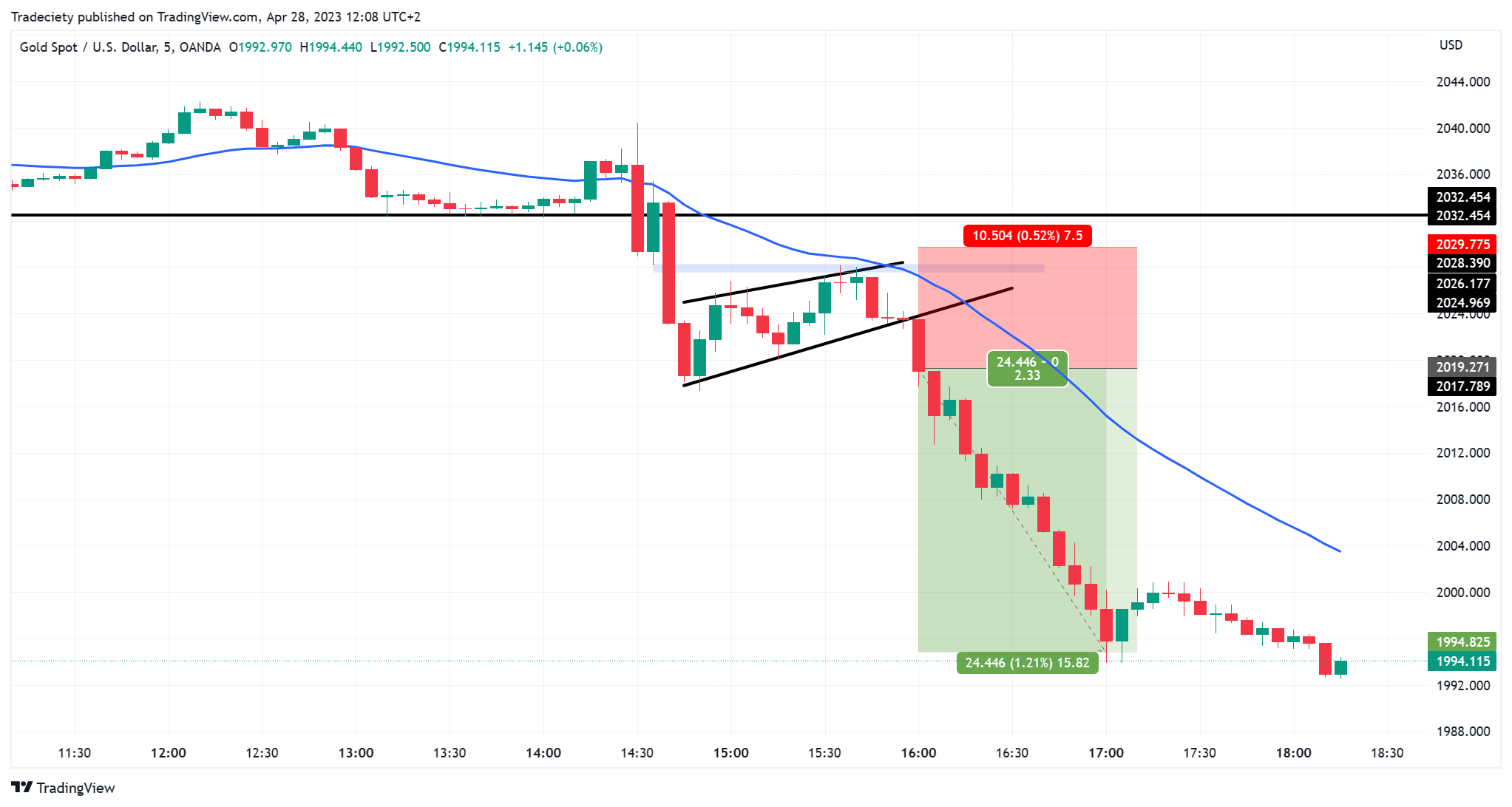

2️⃣ Swing Trading Strategy (Medium-Term & Practical)

4

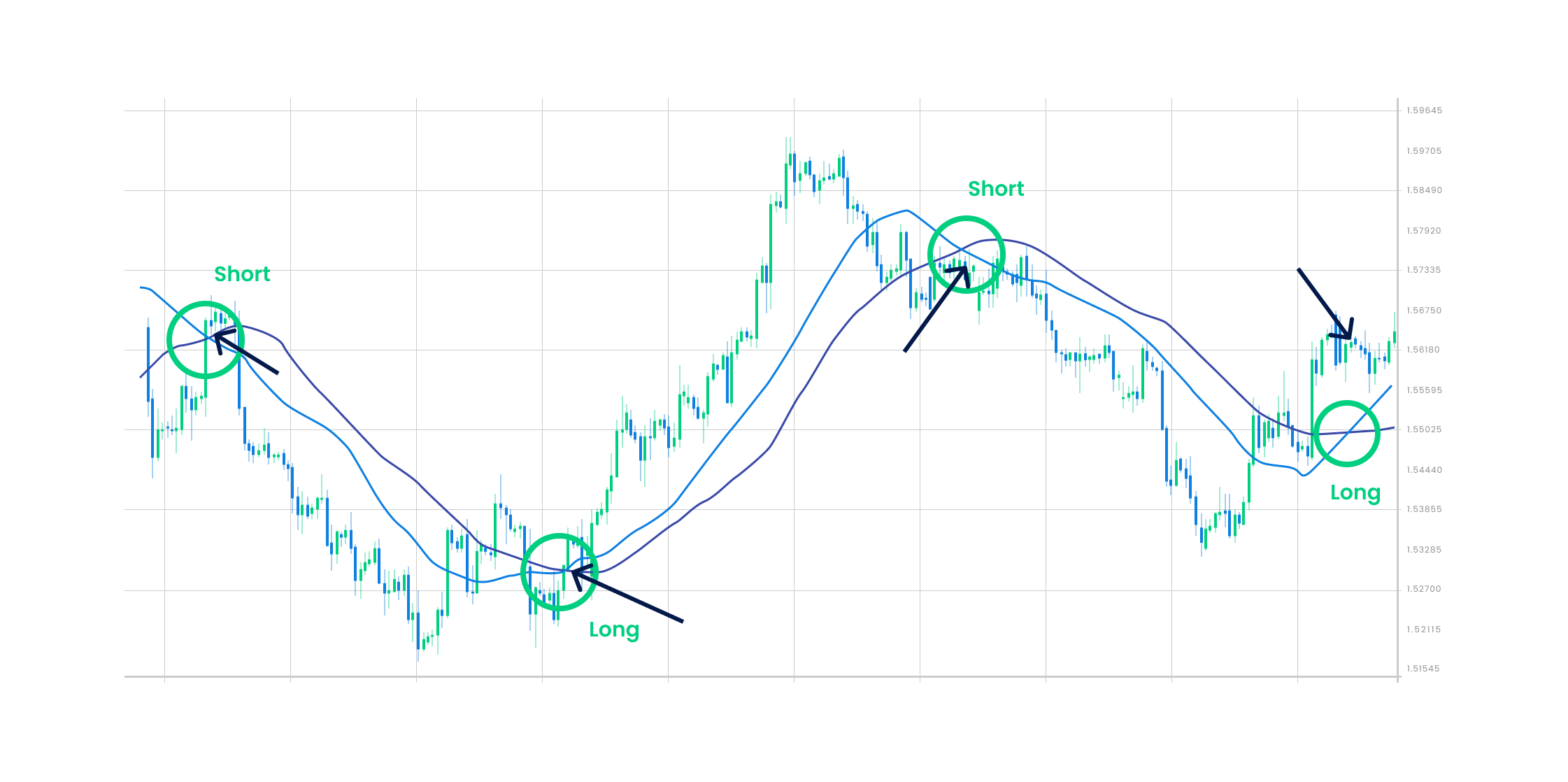

What Is Swing Trading?

Swing trading means holding a trade for several days to capture bigger price movements.

Traders use:

- 4-hour chart

- Daily chart

Target: 50–200+ pips.

Real-Life Example

GBP/USD is trending upward due to positive UK economic data.

Instead of trading small movements, you:

- Enter during a pullback

- Hold the trade for 3–5 days

- Capture a larger move

Why Swing Trading Is Good for Beginners

- You don’t need to watch charts all day

- Lower stress

- Fewer trades

- Better risk-reward potential

If you’re working or running a side hustle, swing trading is more realistic.

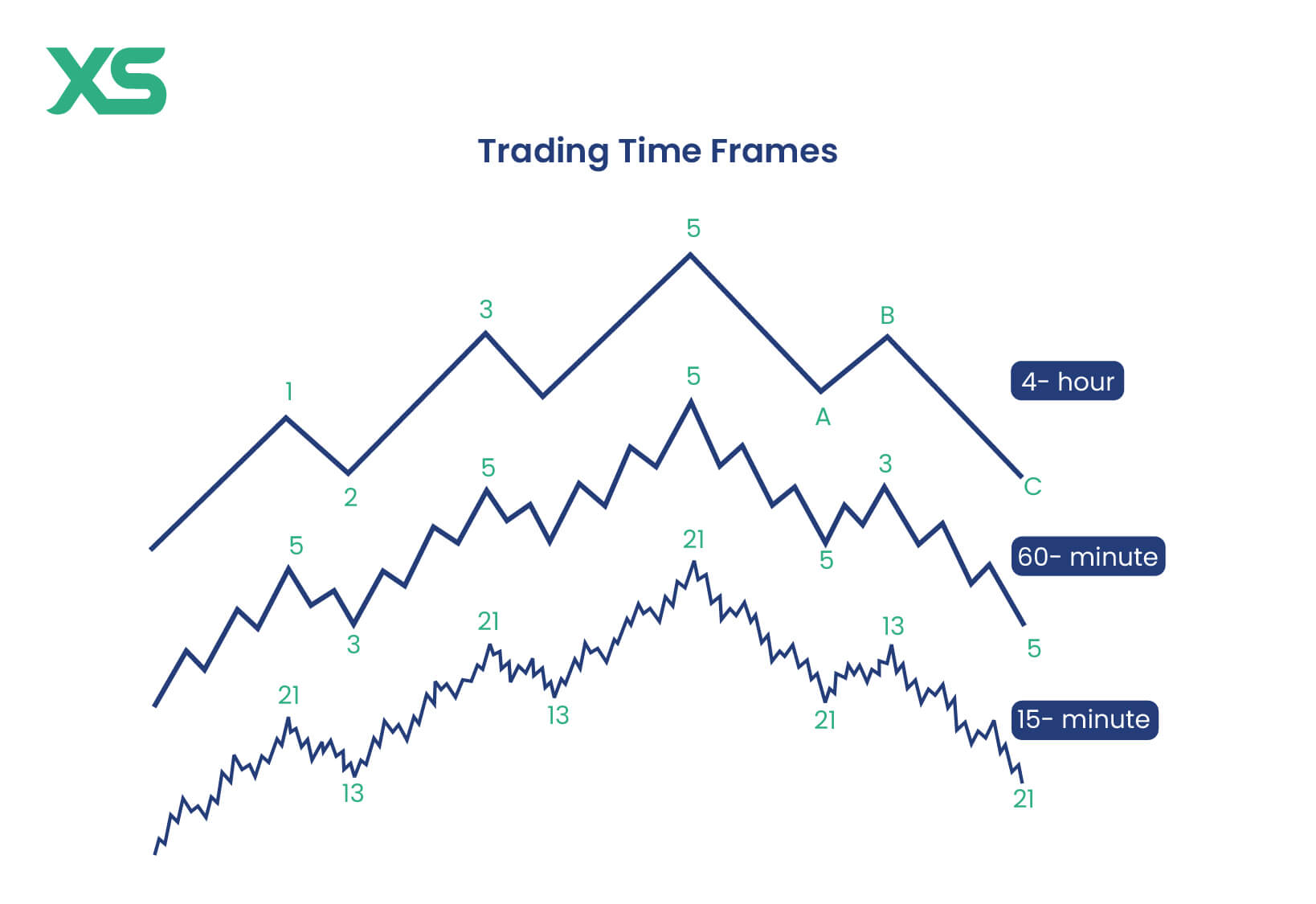

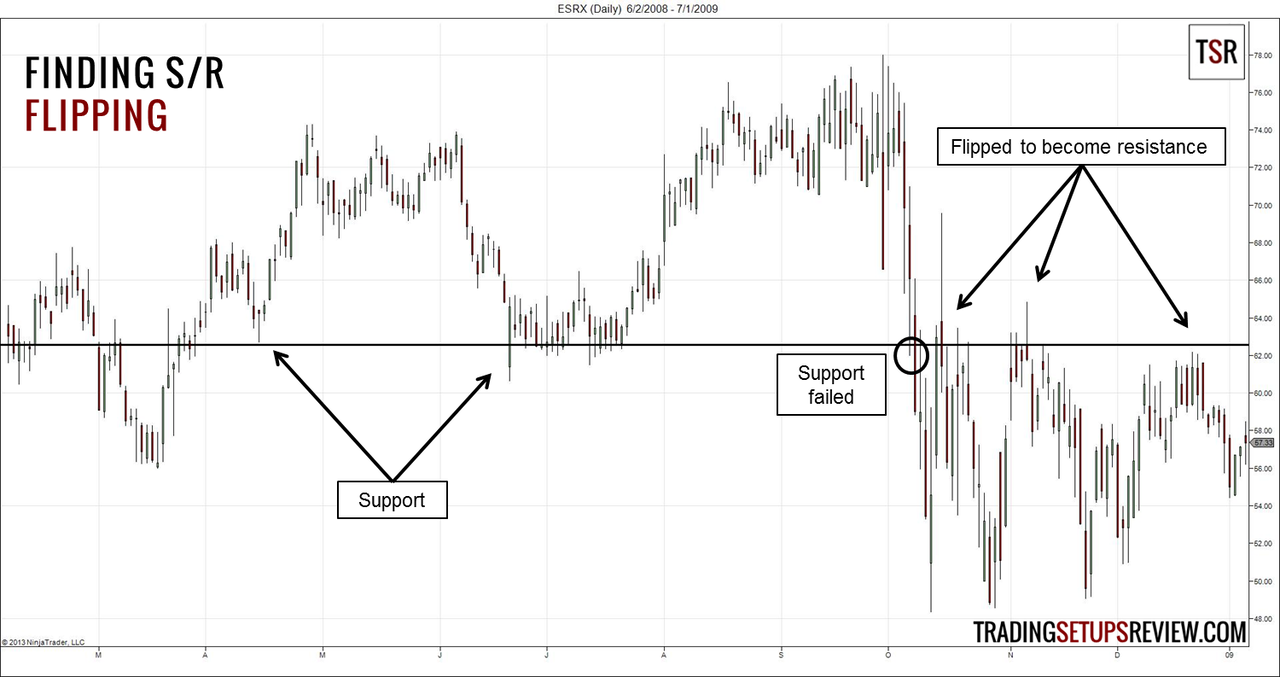

3️⃣ Trend Following Strategy (Beginner-Friendly)

4

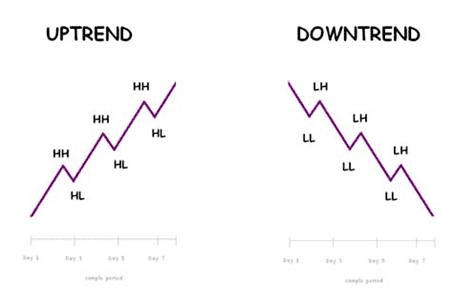

What Is Trend Following?

Trend following means trading in the direction of the overall market movement.

Rule:

- Uptrend → Look for buying opportunities

- Downtrend → Look for selling opportunities

You don’t fight the market.

Real-Life Example

If USD/NGN has been rising due to naira weakness, trend traders look for buy setups rather than trying to predict when it will fall.

Simple logic:

Trade with momentum.

Why Trend Following Works

Markets move in trends due to:

- Interest rate changes

- Inflation

- Government policy

- Global economic news

Following the trend increases probability.

Which Strategy Actually Works?

All three can work.

But for Beginners:

| Strategy | Time Required | Stress Level | Best For |

|---|---|---|---|

| Scalping | High | High | Full-time traders |

| Swing Trading | Medium | Moderate | Working professionals |

| Trend Following | Medium | Low | Beginners |

If you’re just starting:

✔ Start with trend following

✔ Combine with swing trading

✔ Always apply strict risk management

Avoid high-frequency trading if you don’t have time and discipline.

Important Reminder

No strategy guarantees profit.

What actually works long term:

- Risk management

- Emotional control

- Consistency

- Patience

Strategy is just a tool.

Discipline is the real edge.

Final Takeaway

Scalping is fast.

Swing trading is patient.

Trend following is logical.

Choose the one that fits your lifestyle, not the one that looks exciting on social media.

Because in Forex:

Slow, disciplined traders survive.

Emotional traders disappear.